In the classic horror film "Nightmare on Poplar Street", the protagonists try not to fall asleep, lest they fall into Freddy's murderous hands. In Greek reality, the nightmare is on the road with the... pumps, as drivers know that the next time they blink, the price of fuel will have risen again. The problem is that this nightmare seems to have no end and is, in the country we live in, more intense than anywhere else, since petrol, as professionals in the sector admit, is 'climbing' towards EUR 3 per litre.

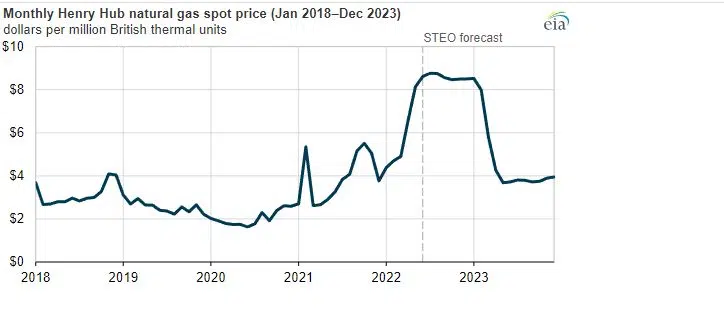

What a great time to have a sporty, power-hungry car! Due to the war, the geopolitical and energy crisis that has arisen, the price of fuel is rallying internationally (but even more so in Greece), reaching historic highs. The data so far shows that Greece is one of the five most expensive countries in the world in terms of fuel prices. But why is this the case?

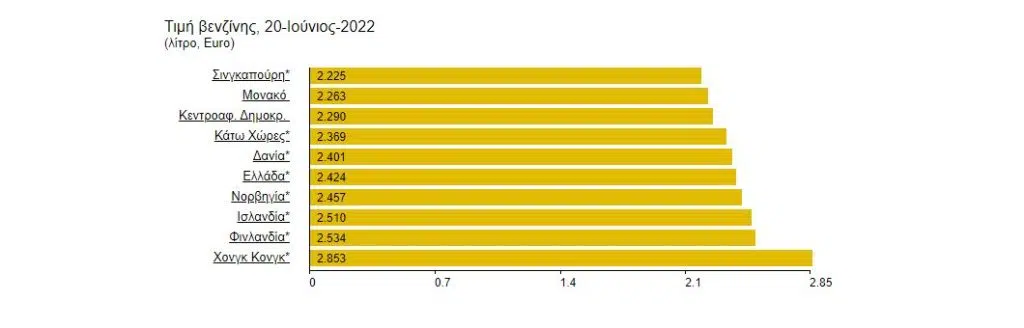

Before we look at why, let's look at how much. The Greek, strange as it may seem, pays more for petrol than the... Monegasque and the Danish (of course, the "ball" also goes to visitors to Greece). According to the latest available data from Global Petrol Prices for June (up to June 20), in the list of countries with the most expensive petrol, Greece ranks fifth, with the cost standing at 2,424 euros per litre.

Don't worry. There are worse things. For example, the most expensive petrol in the world is in Hong Kong (2.853 euros per litre), Finland (2.534), Iceland (2.510), Norway (2.457) and, after Greece, which completes the world's "Top 5", comes Denmark (2.401 euros per litre), the Netherlands (2.369 euros), Monaco, Singapore, etc.

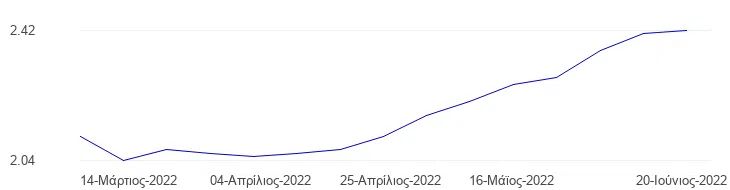

According to the data of GPP processed by TopSpeed.gr, for the period 14 March 2022 to 20 June 2022, the average price of gasoline is 2.18 euros, with the lowest being 2.04 on 21 March 2022 and the highest at 2.42 euros on 20 June 2022. To have a measure of comparison as to why and how much more expensive gasoline is in Greece, in the period under consideration, the average price of gasoline in the world is 1.89 Euro. The funny thing is that by the time the data is recorded, the price of gasoline in Greece has changed again...

Another important element is that it shows the distortion that exists in the Greek market and the right of the Greek consumer to complain. Based on data from the e-katanalotis platform, the increase in the price of petrol at the pumps last month reached 22 cents a litre, i.e. recorded an increase of 10.6%. In the same period, the increase in the price of diesel oil is about 1.5%, proving once again the distortion of the market.

"It will reach 3 euros in August"

Given that traditionally at this time of the year the consumption of petrol increases as they begin their excursions to nearby, seaside destinations, the Panhellenic Federation of Petrol Distributors notes that there is a decrease in consumption of 40% compared to last year. This is perfectly logical, considering that the average cost of plain unleaded has risen even above 40% in several islands, compared to the same period last year.

Comparing the price of plain unleaded petrol on the first day of this summer, with the corresponding day of 2021, the largest increase in island visitors is recorded in Crete and specifically in Heraklion. On June 1, 2022, the average price in the prefecture was 2.344 euros per liter, while just a year ago it was 1.651 euros.

Are we at least "done" here with fuel prices? "No", says the vice-president of POPEK, George Asmatoglou, who does not rule out that in August in some petrol stations, for example in the Cyclades, petrol may even climb to 3 euros a litre, with international oil prices "galloping".

What would happen if we deducted the taxes

But why is fuel so expensive in Greece? It's all the fault of... the memoranda and the endless taxes imposed (not that they didn't exist before and after them) in order to increase fiscal revenues, or, in other words, to close the "holes" for which we suffered for more than a decade. So there you have it: A special consumption tax of EUR 0.70 (or EUR 700 per 1,000 litres) is levied on every litre of petrol. What, you think we're done?

VAT is not the only tax imposed on fuel. According to data from the Ministry of Development, 35.5% of the fuel price corresponds to the refinery, while the lion's share, i.e. 58.8%, corresponds to taxes (VAT, VAT, etc.) and the remaining 5.7% corresponds to the profit margin of distributors and service stations.

As far as taxes are concerned, this year's budget expects revenues of €2.137 billion from the gasoline excise duty and €1.38 billion from the diesel excise duty. This is the main reason why the government's economic staff refuses to even ... listen to the scenario of a reduction in the VAT for a relative "rebalancing" of fuel prices. After all, in order to bring their price to pre-crisis (energy we mean) levels, it would have to... give up revenues of 3.8 billion euros.

However, if the government decided to reduce the VAT by 50%, even for a limited period of time, for example for a quarter, the loss of government revenue would be close to €1 billion, and in any case we would not see pre-crisis prices at the pumps. Instead, the price would remain close to EUR 2, if, of course, international oil prices do not rise further. The supporters of the reduction of the excise duty counter with a logical argument, namely that the reduction of taxes will bring a reduction in the price increase and an increase in consumption which will cover the losses for the state coffers.

However, Finance Minister Christos Staikouras calls the reduction of the VAT "an ineffective measure", citing the European Commissioner for Economic Affairs' call for taxing the excess profits of energy companies over tax cuts, which is what Greece is currently doing for electricity companies. The government's economic staff points out that in case of a reduction of the NPC, there would be a loss in revenue, which would have to be compensated in the budget, with the only ways to do so being to impose new taxes, increase contributions, or further borrowing.